maine tax rates compared to other states

Grow Your Legal Practice. Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate.

Where S My Refund Maine H R Block

Maine Tax Brackets for Tax Year 2020.

. They also have higher than average property tax rates. While it does not tax Social Security income other forms of retirement income are taxed at rates as high as 715. How high are sales taxes in Maine.

The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. The state sales tax rate in Maine is relatively low at 55 but there are no additional county or city rates collected on top of that. 2022 List of Maine Local Sales Tax Rates.

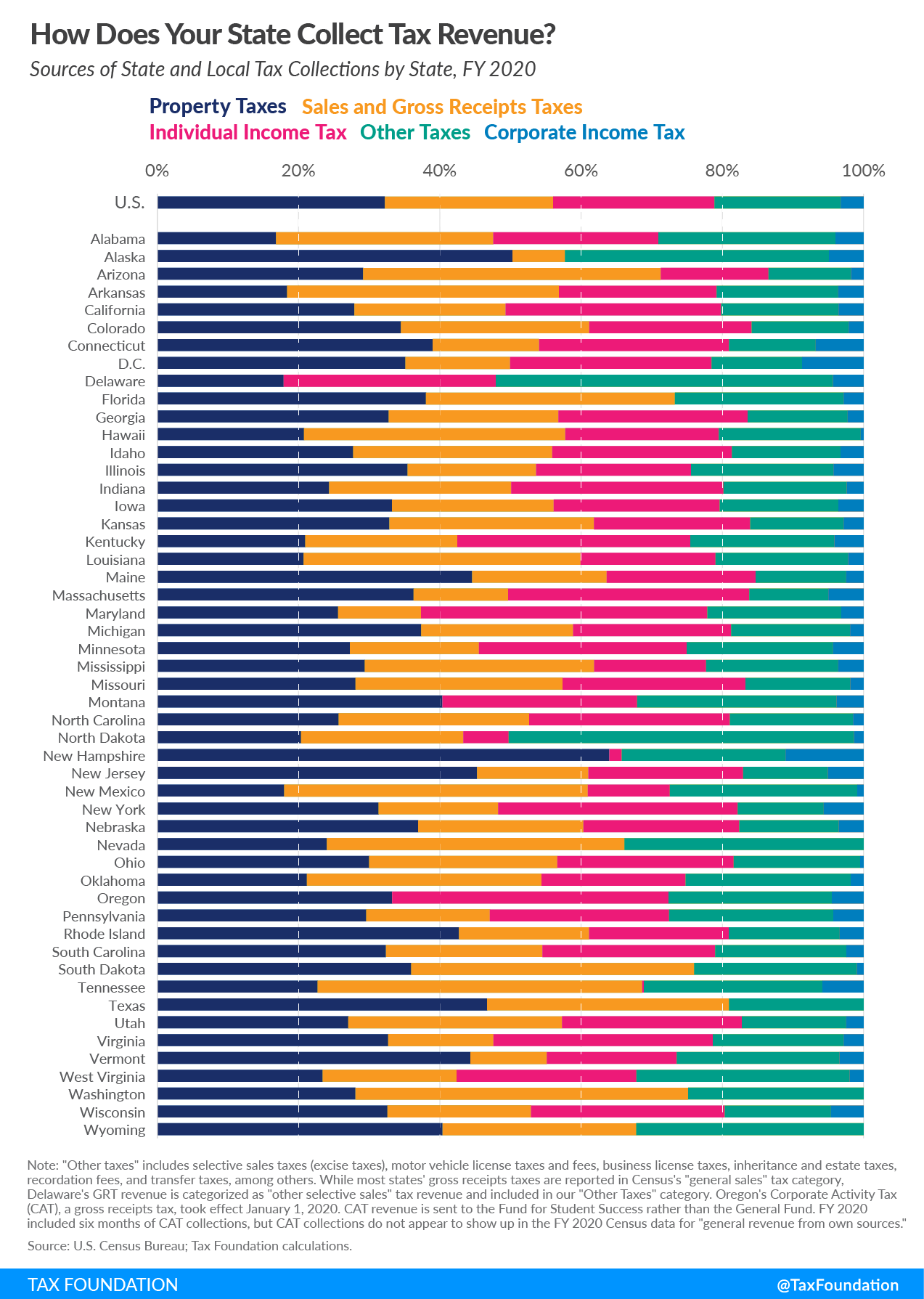

One tax collection area where New Hampshire outpaces its neighbor. More about the Massachusetts Income Tax. Forty-five states and the District of Columbia impose a state sales and use tax.

Compare State Tax Brackets Rates. Effective Real-Estate Tax Rate. According to the Tax Foundation the five states with.

Maines percentage was 105 slightly more than the portion in. According to the Tax Foundation the five states with the highest top marginal individual income tax rates are. Income Tax Rank Effective Sales Excise Tax Rate.

Use this tool to compare the state income taxes in Maine and Pennsylvania or any other pair of states. Several other states have a relatively low tax rate across all income levels. A Comparison of State Tax Rates.

Is not a state but it has its own income tax rate. The states top rate still ranks as one of the highest in the US. Maine has a 550 percent state sales tax rate and does not levy any local sales taxes.

State and Local Sales Taxes. Maines tax system ranks 33rd overall on our 2022 State Business Tax Climate Index. Seniors also benefit from a number of major sales tax exemptions.

More about the Maine Income Tax. Real-Estate Tax Rank Effective Vehicle Property Tax Rate. Vehicle Property Tax Rank Effective Income Tax Rate.

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. Sales Excise Tax Rank Effective Total State Local Tax Rates on Median US. Maine generally imposes an income tax on all individuals that have Maine-source income.

Therefore 55 is the highest possible rate you can pay in the entire state of Maine. See what makes us different. The state sales tax rate in Maine is relatively low at 55 but there are no additional county or city rates collected on top of that.

See how your states tax burden compares with other states. Maine levies taxes on tangible personal property which includes physical and digital products as well as some services. Grow Your Legal Practice.

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. And of course Washington DC. For the 2016 tax year the highest tax rate was lowered again to 715 where it has remained through at least the 2021 tax year.

The five states with the lowest top marginal individual income tax rates are. Maines statewide sales tax of 550 also ranks among the lowest in the country especially because there are no county or city sales taxes anywhere in the state. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

The taxes were ranked as a percentage of total personal income in each state. Grow Your Legal Practice. For example Hawaii has a top tax rate of 11 and 12 income brackets while Iowa has a top tax rate of 853 and nine income brackets.

Arizona Colorado Illinois Indiana Michigan New Mexico North Dakota Ohio Pennsylvania and Utah levy tax on income under 5. Maine also has a corporate income tax that ranges from 350 percent to 893 percent. Therefore 55 is the highest possible rate you can pay in the entire state of Maine.

For your personal Effective IRS Tax Rate use the RATEucator Tool. The five states with the lowest top marginal individual income tax rates are. By Stephen Fishman.

Income Tax Brackets for Other States. Up to 25 cash back See how your states tax burden compares with other states.

Maine Income Tax Calculator Smartasset

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Tax Maps And Valuation Listings Maine Revenue Services

York Maine States Preparedness

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Are You Leaving Money Table Guide Maine Tax Credits And Benefits Tax Credits Benefit Table Guide

State Income Tax Rates What They Are How They Work Nerdwallet Florida Florida Living Beach Trip

Chart 3 Oklahoma State And Local Tax Burden Vs Major Industry Fy 2015 Jpg Private Sector Industry Sectors Burden

Maine Income Tax Calculator Smartasset

Minnesota State Chart Indiana State

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax

The Most And Least Tax Friendly Us States

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Income Taxes The Ides Of March S Corporation Finance

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa West Virginia

America S 15 States With Lowest Property Tax Rates Property Property Tax House Styles